By: Dave Chenet, CFA, CAIA®

| Close | Weekly return | YTD return | |

| S&P 500 | 4,137.52 | 0.79% | 7.77% |

| Nasdaq Composite | 12,123.47 | 0.29% | 15.85% |

| Russell 2,000 | 1,781.16 | 1.50% | 1.23% |

| Crude Oil | 82.66 | 2.14% | 2.98% |

| US Treasury 10yr Yield | 3.52% |

Source: YCharts, Yahoo! Finance, WSJ

Market Recap

A busy week for economic data which, on the whole, showed slowing economic growth and moderating inflation pressures pushed equity indices to modest gains. Inflation data, highlighted by the CPI and PPI reports, came in below expectations with the forward-looking PPI report posting its largest month-over-month decline since the start of the pandemic. Meanwhile, data on the health of the US consumer was mixed; retail sales fell 1% for the month of March while sentiment data ticked up (from still low levels).

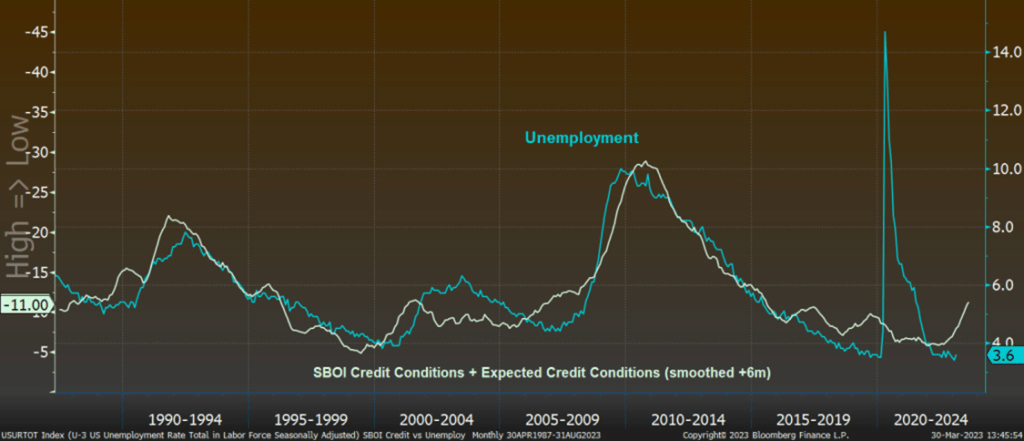

Also released this week were the minutes from the Federal Reserve March meeting which showed growing concern amongst central bankers that recent banking stress would lead to “a mild recession” later this year. Troubling, however, was that the report also noted inflation remains “unacceptably high” and that the reduction in inflation was progressing with “slower-than-expected progress.” While the Fed may be nearing the end of its rate hiking cycle, it may defy market expectations for rate cuts by year-end absent significant deterioration of the labor market, which continues to hold up reasonably well.

Investors will focus on Q1 earnings next week and will hope that strong momentum continues after a solid beat by JPMorgan.

What We’re Reading:

FT: Banking tremors leave a legacy of credit contraction

The Hill: Why the 1980s Recession Haunts the Fed

Chart of the Week:

The tech-heavy NASDAQ index and the Small-Cap Russell 2000 index have deviated in recent weeks, with the NASDAQ significantly outperforming. Markets may be recognizing that smaller companies have a higher reliance on bank financing and the recent banking turmoil has significantly tightened credit conditions. Alternatively, investors may be renewing hopes of another tech-driven run despite high valuations and a higher interest rate/inflationary environment.